A Comprehensive Overview to Browsing IRMAA Brackets and the Appeal Process

Browsing the complexities of the Income-Related Monthly Adjustment Amount (IRMAA) can be a daunting task for Medicare recipients. Recognizing how earnings limits affect premiums is critical for reliable monetary preparation. Many individuals may not recognize the effects of greater earnings on their healthcare expenses. As they check out the subtleties of IRMAA and the allure process, they may uncover vital approaches to handle their expenditures more efficiently. This guide will certainly illuminate the course onward.

Recognizing IRMAA: What It Is and Just how It Functions

The Income-Related Monthly Adjustment Amount (IRMAA) is an essential element of Medicare that impacts beneficiaries with higher incomes. This adjustment is designed to make certain that people who earn over a particular limit add even more towards their Medicare Component B and Part D premiums. The IRMAA operates a sliding scale, implying that as a beneficiary's earnings boosts, so does their premium amount. This technique intends to advertise equity in the Medicare system by dispersing prices according to revenue degrees.

The Social Security Administration identifies IRMAA based on the beneficiary's modified adjusted gross earnings from 2 years prior. They may have alternatives for charm if individuals locate themselves dealing with an unexpected rise in their costs due to IRMAA. Recognizing the nuances of IRMAA is necessary for recipients, as it directly affects their regular monthly health care expenses and economic preparation associated to Medicare coverage.

Revenue Braces and Their Effect on Medicare Premiums

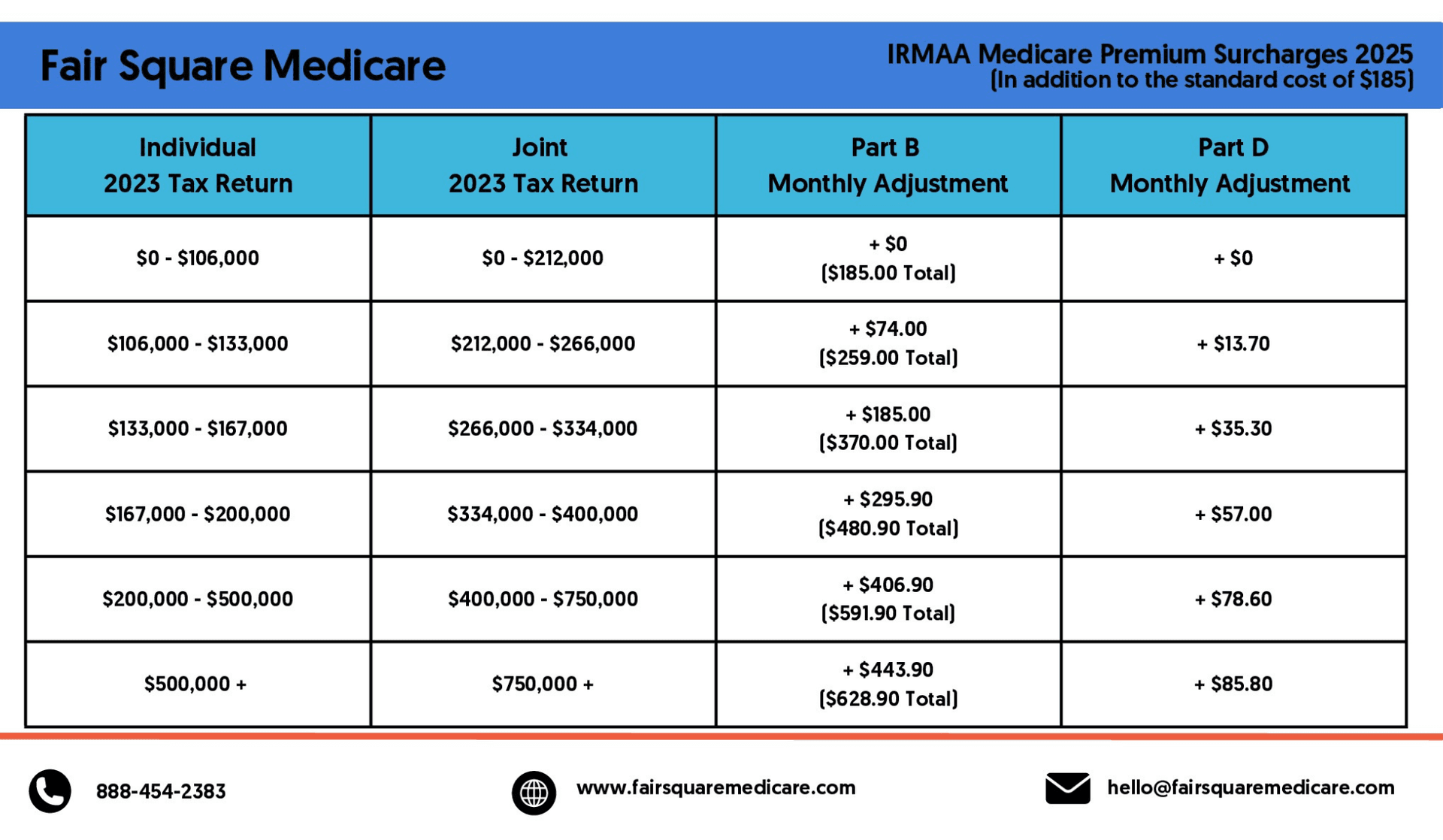

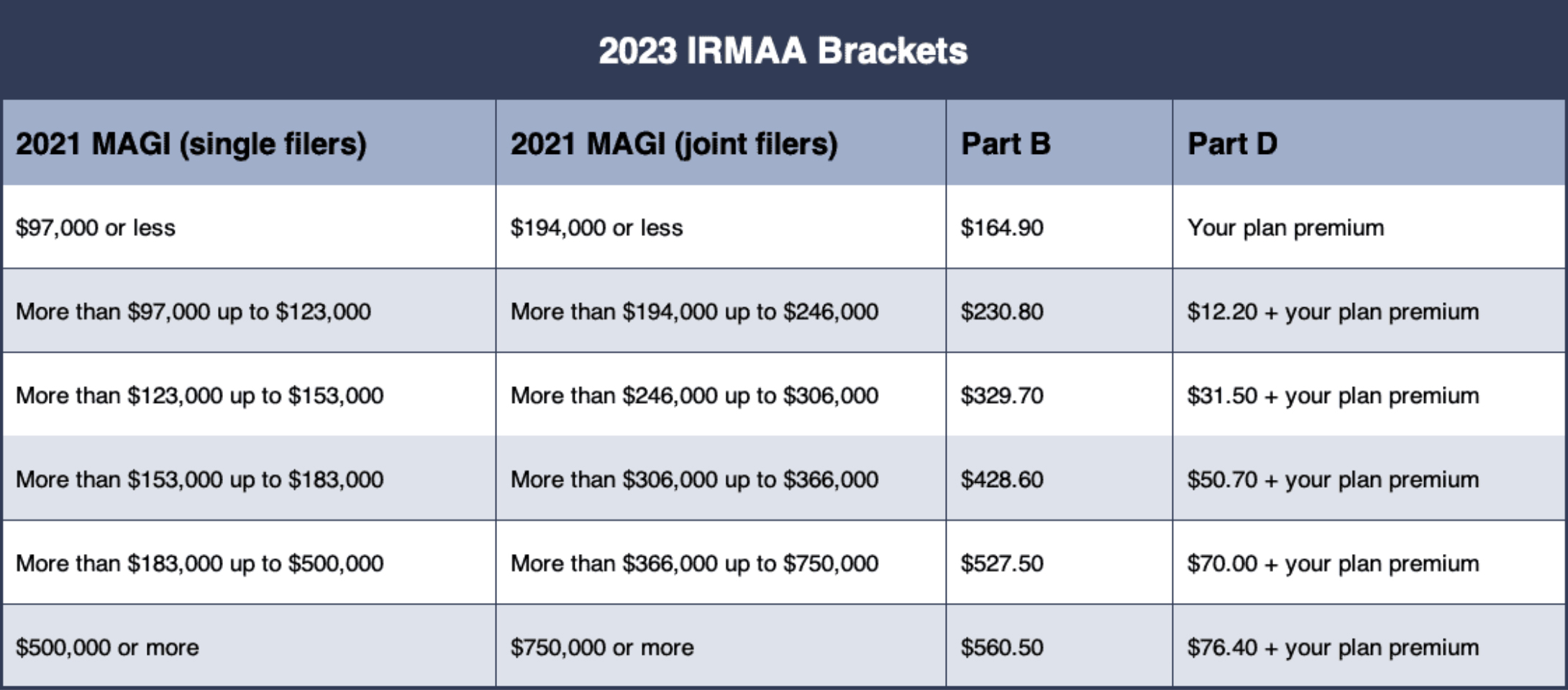

While many recipients depend on Medicare for essential health care protection, income brackets considerably affect the premiums they spend for Part B and Component D. The Centers for Medicare & & Medicaid Solutions (CMS) establishes these braces based on customized adjusted gross revenue (MAGI) from 2 years prior. As recipients' income degrees rise, so do their costs, often causing greater costs for those earning over specific thresholds.

For 2023, individuals gaining over $97,000 and pairs making over $194,000 face raised premiums, with prices rising through different rates. This structure intends to ensure that higher-income beneficiaries add even more towards the price of their coverage. Comprehending these income braces is essential for beneficiaries, as it straight influences their economic planning and health care accessibility. Recognition of just how income levels influence Medicare premiums can help beneficiaries navigate their options and prevent unforeseen expenditures connected to their healthcare coverage.

How IRMAA Is Calculated: A Step-by-Step Break down

Understanding how IRMAA (Income-Related Monthly Adjustment Amount) is calculated is important for Medicare beneficiaries facing increased costs. The estimation starts with the recipient's modified adjusted gross earnings (MAGI), that includes adjusted gross earnings plus tax-exempt rate of interest. This earnings is assessed based upon one of the most recent income tax return, generally from 2 years prior.

The Social Protection Management (SSA) categorizes beneficiaries right into different IRMAA brackets, each corresponding to a particular MAGI variety. As earnings boosts, so does the premium adjustment, leading to site here higher monthly prices for Medicare Component B and Component D.

Recipients may find their IRMAA quantity on their Medicare Premium Expense. It is vital for people to stay informed about their revenue standing, as changes can impact their IRMAA estimations and ultimately their healthcare expenses. Recognizing these actions aids in effective economic planning for Medicare beneficiaries.

Browsing the Appeal Process: When and Just How to Appeal IRMAA Determinations

Navigating the appeal procedure for IRMAA decisions can be a critical action for beneficiaries that believe their income analysis is inaccurate. Initiating an allure requires comprehending the particular premises for contesting the IRMAA choice, which usually focuses on revenue discrepancies or certifying life occasions that may impact one's income degree. Recipients must gather relevant documents, such as tax obligation returns or evidence of revenue adjustments, to validate their cases.

The appeal needs to be sent in composing to the Social Security Administration (SSA) within 60 days of the preliminary decision. It is important to follow the SSA's guidelines very carefully, consisting of providing your Medicare number and clear details about the charm. When sent, the SSA will certainly assess the situation and alert the recipient of their decision. If the charm is not successful, further actions, consisting of a reconsideration request or a hearing, can be gone after to make certain all avenues are checked out.

Tips for Taking Care Of Healthcare Expenses Connected to IRMAA

As beneficiaries face increased healthcare costs because of IRMAA, applying reliable approaches can aid take care of these expenditures extra successfully. Assessing one's revenue consistently is crucial; variations may qualify people for reduced IRMAA brackets. Furthermore, checking out options such as Medicare Savings Programs or state assistance can offer economic alleviation.

Beneficiaries must likewise consider utilizing preventative services covered by Medicare to reduce unexpected medical care expenses - security brackets. Engaging with doctor to talk about treatment plans and possible alternatives can further minimize costs

Making the most of using Health and wellness Financial savings Accounts (HSAs) or Versatile Investing Accounts (FSAs) allows for tax-advantaged cost savings for medical expenses. Finally, beneficiaries need to stay informed concerning modifications to Medicare policies and IRMAA limits, which can affect overall medical care costs. By proactively taking care of these elements, recipients can alleviate the financial problem associated with IRMAA.

Often Asked Questions

Can IRMAA Impact My Social Safety And Security Benefits?

What Occurs if My Earnings Modifications After IRMAA Resolution?

If an individual's earnings changes after IRMAA determination, they might receive a lower costs brace. They can appeal the decision by giving why not check here documentation of the earnings adjustment to the Social Safety and security Management for testimonial.

Are There Exceptions for IRMAA Calculations?

There are restricted exceptions for IRMAA computations, primarily based upon life-changing occasions such as marital relationship, divorce, or fatality of a partner (security brackets). Individuals might need to supply documentation to receive these exemptions during the review procedure

How Usually Does IRMAA Adjustment?

IRMAA changes every year, commonly based on income changes reported to the internal revenue service. These changes mirror rising cost of living and alterations my latest blog post in revenue limits, affecting individuals' premiums for Medicare Part B and Part D every year.

Can I Obtain Assistance With IRMAA Settlements?

People may seek support with IRMAA payments through financial advisors, social solutions, or Medicare sources. Various programs exist to help manage prices, ensuring people can access essential medical care without excessive economic worry.

The Income-Related Monthly Adjustment Amount (IRMAA) is a crucial part of Medicare that influences beneficiaries with greater earnings. The IRMAA operates on a gliding range, indicating that as a beneficiary's income rises, so does their premium amount. The Social Protection Management identifies IRMAA based on the beneficiary's changed adjusted gross income from two years prior. Browsing the appeal process for IRMAA resolutions can be a crucial action for recipients who think their earnings analysis is wrong. Initiating an appeal requires recognizing the details grounds for contesting the IRMAA choice, which usually revolves around income discrepancies or certifying life occasions that might impact one's income level.